How to report on Minimum Wages and Living Wages? What do you compare and what do you report on? We interviewed our colleagues Paulien Osse (Living Wages Global Lead at WageIndicator) and Daniela Ceccon (Data Director at WageIndicator) to shine some light on the matter and share the insights that WageIndicator has gathered throughout the years.

|

|

||

| Paulien Osse | Daniela Ceccon |

First of all, let’s start at the beginning: what is the difference between a Minimum Wage and a Living Wage?

Daniela Ceccon: The main difference is that the Minimum Wage is a legal Minimum Wage set by the government that companies have to pay to their employees. Often a lot of discussion happens from the government with the social partners prior to defining the Minimum Wage and occasionally the cost of living is taken into account. The Living Wage is the income an employee needs to be paid in order to lead a decent life in the country or area where they work and live. This amount is based on the cost of living in their area.

Paulien Osse: As a company or organisation, you can't pay your employees below the Minimum Wage. Full stop. The Minimum Wage is legally binding.

WageIndicator compares Minimum Wages and Living Wages quite often, why is that?

Paulien Osse: Yes, we compare the level of Minimum Wages and Living Wages year after year and quarter after quarter. We do this on purpose. That way, we can measure whether the Minimum Wages around the world are improving. Both Minimum Wages and Living Wages are hot topics on the agenda of politicians. And when these topics are discussed, it’s important to provide data and context and show how they relate to the cost of living. Because throughout the years, our data has shown us that many countries don’t have a Minimum Wage that is high enough to cover the cost of living.

Example of comparison, quarter by quarter

Example of comparison in percentages

How do you define what the Minimum Wage is and what the Living Wage is?

Daniela Ceccon: Well, for our comparison, we take the lowest of the region that is comparable to the region that we’re researching. So, for example, in Indonesia, we have a region. In that case we take the lowest Minimum Wage among the Minimum Wages of that region. In general we provide our clients with the lowest and the highest, so they have an idea of the boundaries. We can of course also provide additional services to our clients where we give the exact Minimum Wage that applies to a specific location and also to their sector. That specific location is based on the GPS codes the companies share with us. If you're a company with 20,000 or 50,000 locations - and we have those as clients - then you want to have data from all the locations with a GPS link. It takes us a bit of time to dive into the correct sector and occupation but pretty swiftly we get an idea of ‘yes, they’re on track with the Minimum Wage’ or ‘no, they’re not’.

Why should companies report on this?

Paulien Osse: All companies - regardless of their size - should at the very least have an internal reporting process for this. That way they know how compliant they are in relation to the Minimum Wage and can compare this with the different types of Living Wages that WageIndicator uses:

- Basic wage (the salary that the company pays);

- Minimum Wage;

- Living Wage - typical family - lower bound;

- Living Wage - typical family - higher bound;

- Living Wage - single income earner - lower bound;

- Living Wage - single income earner - higher bound.

We compare these year after year and can provide the company with the numbers for all Minimum Wages and Living Wages variables. Then every year, the company compares their basic wages with these five variables. The next step for the company is to analyse the preferred scenario. Do they only want to comply with the Minimum Wages, Minimum Wages plus the Living Wage for a typical family lower bound or Living Wages for a typical family higher bound. This internal report is often the basis of their annual report. Furthermore the company also knows and is in control of what is happening and can devise the financial year plans accordingly. To get insight in the Living Wage estimates, check this page.

Many companies contact WageIndicator to help them report on Living Wages. What’s your approach?

Daniela Ceccon: Yes, we don’t have to push or convince anyone. Many companies approach us because they want to report on Living Wages. When we discuss the plan of action and how we can support these companies, we always recommend the same first step: check the Minimum Wage!

You mentioned that companies can also have challenges within their own operations. What would those be and how do you help them?

Paulien Osse: Yes, some people are not great with numbers. So we provide, for example, guidance on how to make certain calculations. We talk them through each step. And if they get stuck again, then we go through everything again - either the next day or another time. And last but certainly not least: our datasets also come with a 24-hour service for any inquiries that the companies have. In our experience, many companies are often a few questions away from being ready for comparison. If needed, we can also check their comparisons for mistakes to make sure they report correctly in their annual report.

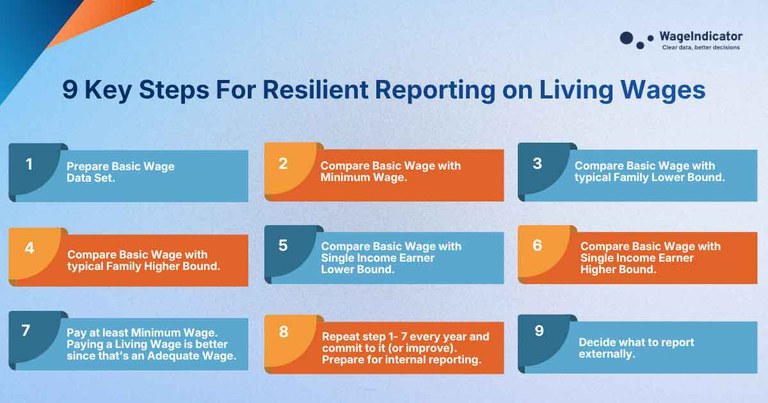

9 Key Steps for Resilient Reporting on Living Wages

Step 1. Prepare the basic wage data set. Use 2025 data. July or October. This basic wage data set comes without bonuses and allowances. Only those bonuses or allowances which all employees get may stay. Like a holiday bonus. Everything related to performance needs to be excluded. In-kind? Try to avoid food and transport. If relevant include housing or healthcare. All in-kind should never be more than 25% of the Living Wage

Step 2. Compare the Basic Wage with the correct Minimum Wage. Use the latest available data. In some countries Minimum Wages are different per region, or city, per sector and sometimes occupation.The perfect Minimum Wage data set is GPS coded. The codes are linked to the company-locations.Mark these regions where Basic Wage is below the Minimum Wage and repair. And share the distance.

Step3. Compare the Basic Wage with the Typical Family lower bound. Use October 2025 data. Check in which regions the Minimum Wage is higher than Typical Family lower bound. Mark these regions. And share the distance.

Step 4. Compare the Basic Wage with the Typical Family higher bound. Use October 2025 data. Check in which regions the Minimum Wage is higher than Typical Family higher bound. Mark these regions. And share the distance.

Step 5. Compare the Basic Wage with the Single Income Earner lower bound. Use October 2025 data. Check in which regions the Minimum Wage is higher than Single Income Earner lower bound.. Mark these regions. And share the distance.

Step 6. Compare the Basic Wage with the Single Income Earner higher bound. Use October 2025 data. Check in which regions the Minimum Wage is higher than Single Income Earner higher bound. Mark these regions. And share the distance.

Step 7. Decide whether you want to focus on just paying the Minimum Wage, or above the Minimum Wage = Living Wage = Adequate Wage.

Step 8. Do the same exercise year on year, to understand whether the company is still Minimum Wage and Living Wage compliant (or on its way towards it).

Step 9. Decide what to report externally. Ideally precise, as investors prefer this, with the data set which is used. Example: Basic Wage, October 2025. WageIndicator Living Wage estimates October 2025. Latest available Minimum Wage. Living Wage Gaps for example: 10% of personnel in country x. This gap will be closed in October 2027.

Date: 20 November 2025