Last update: 20230221 (new updated expect last week august 2023)

1. Introduction

1.1 Introducing Living Wages

According to Article 23 of the United Nations Universal Declaration of Human Rights, every individual who works has the right to just and favourable remuneration to ensure such a person and his or her family an existence in dignity. The 17 United Nations Sustainable Development Goals (SDGs) set for 2030 and adopted by all UN member states in 2015, add urgency to Living Wage implementation, since paying a Living Wage furthers at least eight out of the 17 SDGs (Kingo, n.d.). In response to this societal pressure, an increasing number of companies have made strides by committing to pay their employees a Living Wage; some have even been cooperating with their suppliers to achieve Living Wages in their supply chains (Mapp, 2020).

Though definitions of a Living Wage vary slightly over time and across countries, a common underlying concept does exist. Living Wage denotes the minimum income that is necessary for an employed person to meet his or her basic needs without government intervention in the form of subsidies (Gerber, 2017). Such needs include food, clothing, shelter, childcare, transportation, medical expenses, recreation and modest vacation time. According to Mankiw (2020) the concept of a Living Wage typically does not cover the ownership of property, the repayment of debt, savings for retirement, savings for children’s education, and savings for anything that has to do with emergencies, aside from a small emergency fund. Figure 1 shows a selection of definitions of a decent wage.

Figure 1 Definitions of a decent wage (selected)

- The International Labour Organisation (ILO) states that “Wages are among the most important conditions of work and a major subject of collective bargaining. The ILO is committed to promoting policies on wages and incomes that ensure a just share of the fruits of progress to all and a minimum living wage for all employed in need of such protection.”

- The Mexican Constitution (1917) states that ‘the general Minimum Wage must be sufficient to satisfy the normal necessities of a head of family in the material, social and cultural order and to provide for the mandatory education of his children’.

- The Brazilian Constitution (1988) stipulates that the national Minimum Wage must be capable of satisfying their basic living needs and those of their families with housing, food, education, health, leisure, clothing, hygiene, transportation and social security, with periodical adjustments to maintain its purchasing power.

- Global Living Wage Coalition: “a remuneration received for a standard workweek by a worker in a particular place sufficient to afford a decent standard of living for the worker and her or his family. Elements of a decent standard of living include food, water, housing, education, health care, transport, clothing, and other essential needs, including provision for unexpected events”.

- Asia Floor Wage proposes a wage for garment workers across Asia that would be enough for workers to live on.

- Living Wage Aotearoa New Zealand defines a Living Wage as the income necessary to provide workers and their families with the basic necessities of life.

- The campaign in Vancouver defines Living Wage on the principle that full time work should provide a family of four with two working the basic needs, not keep them in poverty.

This report deals with the constituting elements in WageIndicator’s Cost-of-Living data collection, the calculation of WageIndicator’s Living Wages, and the adjacent benchmarks. In this WageIndicator Living Wages Worldwide update in February 2023 we also introduce the concept of Living Income. The Living Income concept is created for those people who run a small family business. More on this concept in Chapter 2.11 and 2.12.

1.2 Why promote the concept of a Living Wage?

The term Living Wage differs from the terms Minimum Wage and subsistence wage. A Minimum Wage is mandatory, determined through legislation. It should meet an individual’s basic requirements but may imply that a worker relies on government subsidies for additional income. A subsistence wage is a minimum income that only provides for the bare necessities of life. In contrast, a Living Wage is not mandatory, but paid voluntarily. Whatever the differences, all these concepts attempt to establish a price floor for labour (Mateer et al., 2020).

The importance of a Living Wage lies, among other things, in the fact that it assumes a ‘normal’ working week (as defined per ILO Convention 1 of 1919). This concept implies avoiding excessive overtime hours, taking on more than one job, avoiding the risk of becoming a bonded labourer, or to put one’s children to work while forsaking education, for not to be denied basic human rights such as food, clothing, shelter, suffer social depravities, or be able to withstand crises. That being said, paying workers a Living Wage might motivate them to stay with the company, thus reducing recruitment and training costs, and resulting in healthier employees, thus reducing the loss of working hours due to sickness (Gerber, 2017). Generally speaking, the concept of a Living Wage must take the needs of both businesses and workers into consideration.

Regarding the needs of workers, most Living Wage models include the costs of food, rent, transportation, childcare, healthcare, and taxes. Despite the general understanding that a Living Wage makes for ethical and economic contributions, a worldwide standard for calculating Living Wages has still to be set. The present paper of February 2023, and the version of May 2022 and February 2022, aim to contribute to a solid foundation for such a global, unified methodological framework. These papers followed an design, already outlined in 2014 to calculate country-level Living Wages for a large number of countries with these characteristics (Guzi & Kahanec, 2014):

- Normatively based;

- Estimates sensitive to national conditions;

- Based on transparent principles and assumptions;

- Easy to update regularly;

- Estimates to be published online.

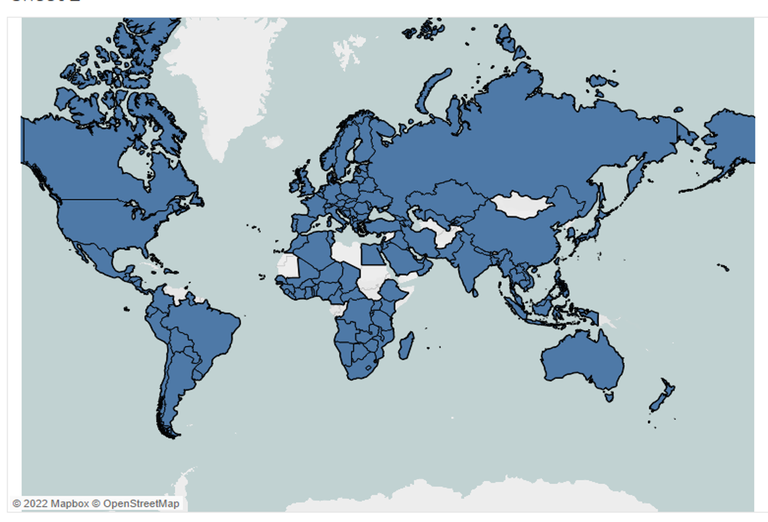

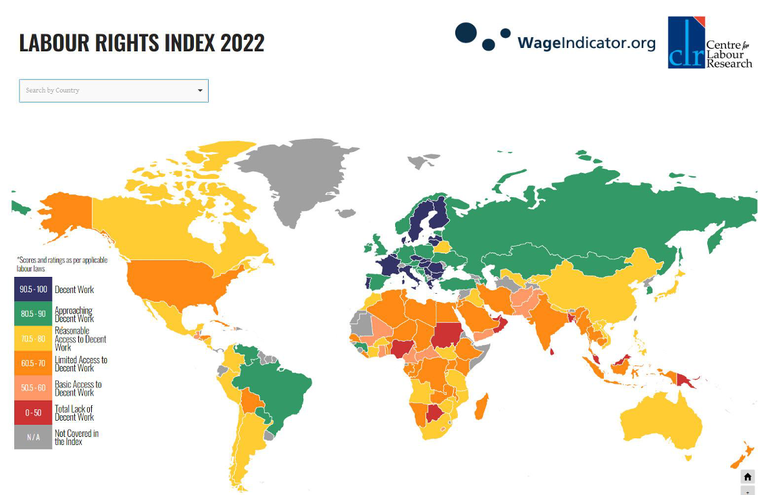

1.3 Introducing WageIndicator Foundation

WageIndicator Foundation is a Netherlands-based NGO that operates frequently visited websites with job-related content in the national language(s) in 196 countries (Figure 2). In 2001, WageIndicator launched its first website in the Netherlands, its first European websites in 2004, and from 2006 onwards grew to websites in 208 countries, including non-recognised and overseas territories. All websites provide easily accessible information related to the national Labour Laws, Collective Agreements, Minimum Wages, Living Wages, the Gig Economy and even Celebrity (VIP) Salaries, in national languages. All websites have Minimum Wage information, and most websites also run a Salary Check Tool. Web visitors are invited to complete a Cost-of-Living or Salary Survey while checking their rights or minimum wage information. In 2022 the sites received 36 million unique visitors across the globe.

Figure 2 Map of WageIndicator countries and their URLs

Source: WageIndicator Foundation

Since its start, WageIndicator has developed database-driven tools to collect data and to generate web pages from this data. For this purpose WageIndicator operates a Living Wage database, a Salary database, a Minimum Wage database, a Labour Law database, and a Collective Agreements database. These databases are suitable for worldwide data collection, and comparable and interlinked, and all result back into the web pages in over 61 national languages. However this doesn’t mean all data was and is collected via the web. In at least 40 percent of the countries data is collected face-to-face. Yet, as soon as there is Wi-Fi, the data can be sent to our central database.

By 2023 the foundation has offices in Amsterdam (HQ), Bratislava, Buenos Aires, Cairo, Cape Town, Jakarta, Islamabad, Maputo, Pune, and Venice. The foundation has a core team of 40 persons and some 100 associates - specialists in wages, labour law, industrial relations, data science, data collection, statistics, - from all over the world. On a yearly basis, WageIndicator Foundation offers approx. 150 internships to students from different universities. FLAME University in Pune, India, plays a key role in the intern program.

1.4 History of WageIndicator’s Living Wage data collection

In October 2013, WageIndicator developed a plan to collect data about the prices of food items. Given the huge numbers of web visitors, it seemed easy to post a teaser on all web pages asking web visitors for the actual price of a single food item. Once they had entered a price, they were asked to key in the prices of other items in the Cost-of-Living survey. Items asked about the prices of food, housing, drinking water, transport, and clothing and footwear. The methodology of the Living Wage data collection and calculation has been described in Guzi and Kahanec (2014, 2017, 2019) and Guzi et al. (2016, 2022). The available estimates allow users and stakeholders to share and compare Living Wages across countries and regions based on a harmonised methodology. This methodology facilitates quarterly updating of the database (see chapter 3.1. for further details of the history of the data collection).

Since 2013, the data collection has advanced successfully, evoking the interest of stakeholders in the field of Living Wages. Demands for detailed information about Living Wages beyond country-level arose, challenging the business model underlying the Living Wage data collection. The data collection started with funding from development aid projects and did not include delivery of data to multinational enterprises. Hence, the cost of collecting data was estimated and prices had to be set. The first multinational client could be welcomed in 2018. Since then, WageIndicator has sold its regional Living Wages to a growing number of clients, both multinational enterprises, with locations in many countries and NGOs like FairWear Foundation and MSF (Médecins Sans Frontières).

Since 2014 WageIndicator has taken part in the global discussion on Living Wages (see Annex 7). Two recent examples: on 9 November 2021, WageIndicator presented the Living Wage data collection methodology as part of the OECD Living Wage Workshop. On 24 June 2021, WageIndicator contributed to a discussion about implementation of Decent Wages in Tea Estates, Ready Made Garment, Leather, and Construction in Bangladesh.

Compared to the 2022 WageIndicator Living Wages update (Guzi et al, 2022), two changes in this report are relevant:

- Since July 2022 WageIndicator offers next to the Standard and Typical Family Living Wage a Living Income for Typical families. More on this in Chapter 2.11 and 2.12

- From the January 2023 release the Individual Living Wage will not be presented anymore. The data collection will not change. More on this in Chapter 4.6.1.

In 2023 WageIndicator will work on two new initiatives.

- The Living Wage Plus. This product is basically a full bag of extras on top of the basic Living Wage. The extras will not be added to the Living Wage, but users can pick components, like car, expenses for cinema/culture, eating out, care.

- The development of the Living Tariff. This product focuses in the first place on platform workers who are not on the payroll. The idea behind the Living Tariff is to make clear which items are needed to come to a decent tariff per hour. The tariff includes items like: food, housing, transport, clothes, water, similar to the components from the Living Wage and Living Income. On top of these items cost related items are included for specific occupations. Like a car and petrol for the taxi driver, a bike and helmet for the rider, a laptop and extra internet cost for the online gig worker. Next to this, the Living Tariff includes components like: social security, insurance, pension, and time for administration and training. For some jobs, general waiting time will be included.

1.5 Organisation of the Living Wage data collection

To finalise this introduction, we present an outline of the production process resulting in quarterly updated releases of Living Wage data on a global scale. Table 1 gives an idea of this recurring operation and the organisation behind it. The ensuing chapters elaborate each of the steps, with the choices behind their design and performance. The reader should be aware that this regards work in progress.

Table 1 WageIndicator Living Wage data collection process

|

RECRUIT |

Recruit & train interns and freelancers from all over the world for data-collection tasks (see Chapter 3) |

| COLLECT | Assign collection of data for countries & regions per quarter; manage feedback from data collectors to improve data (see Chapter 3) |

| MAINTAIN | IT unit to maintain & improve the surveys |

| CLEAN & CALCULATE | Clean the data, control for outliers, create scripts and calculate; enrich the data with input from other relevant sources (see Chapter 4) |

| CHECK & PRESENT | Quality check and presentation unit; enrich the data with input from other relevant sources (see Chapter 5); create visuals and sheets for WageIndicator clients (see Chapter 4, 5) |

| PRESENT & SELL DATA | Present the data to clients, calculate salary gaps, do projections, assist in implementation (see Chapter 5,6,7) |

| COORDINATE | Make sure that each quarter, there is enough and timely data for clients and WageIndicator websites and a growing set of countries and regions within; improve the data quality continuously; take part in the global discussion on Living Wages, keep the team happy. |

1.6 Principles of data collection and calculations

WageIndicator applies the principle that the data collection in the Cost-of-Living survey and thus the Living Wage calculations takes place independently of employers or their organisations, workers or trade unions, or any other stakeholder.

All data collectors are trained on ethics and adhere to WageIndicator’s Code of Conduct and Safeguarding policies.

2. Items in the Living Wage data collection

This chapter details the ten expenditure categories included in the Living Wage, Living Income data collection, reflecting the requirements needed for an individual and her/his family to meet their basic needs. Chapter 3 explains how data about the prices of the items in these categories are collected in the WageIndicator Cost-of-Living survey.

The ten expenditure categories are:

- Food

- Housing and utilities: water, electricity, heating, garbage collection, routine maintenance, cooking fuel

- Transport

- Drinking water

- Phone

- Clothing

- Health

- Education

- 5 percent provision for unexpected events

- Mandatory contributions and taxes on employee’s side, or employees and employers side

Living Wage and Living Income are based on the categories 1 till 9. Category 10 shows the difference between Living Wage and Living Income.

- For Living Wage: mandatory contributions and taxes on the employee's side only.

- For Living Income: mandatory contributions and taxes on the employee's and on the employer's side.

More on Living Income, see. Chapter 2.11 and 2.12.

2.1 Food basket

A nutritional requirement for good health proposed by the World Bank equals 2,100 calories per person per day (Haughton & Khandker, 2009). The food consumption patterns largely vary across countries, and hence it is important that these differences are addressed in the food basket. The food balance sheets published by the UN Food and Agriculture Organisation (FAO) include the supply of food commodities available in every country and reflect the potential food consumption basket of an average individual. WageIndicator takes care that an average food basket in a country meets the demand of 2,100 calories and that the food items are sufficiently balanced between the basic food groups, namely vegetables, grains, fruits, dairy, meat, beans, oils, and sweets.

Table 2 shows the 63 items in the food category, for which prices are collected in the Cost-of-Living survey. These items constitute a nutritious food base. As explained in detail in paragraph 4.3.1, a model diet for each country has been developed on the basis of the FAO food balance sheets and reflecting the varying food consumption patterns and habits of each country. The food items listed in the survey are designed to include all food items from the FAO database. The survey does not require a respondent to complete prices for all the items (although this option is available to respondents).

Table 2 List of food items in the Living Wage Food basket

|

Apples |

Other fish (marine) - fresh, frozen or canned | Pig meat |

| Bananas | Flatbread or pita | Pineapples |

| Barley | Freshwater fish - fresh, frozen or canned | Plantains |

| Beans - dry | Groundnuts (Shelled Equivalent) | Potato |

| Bell pepper or sweet pepper | Honey | Prawns, shrimp, crayfish, crabs, lobsters, krill and similar - fresh, frozen or canned |

| Berries | Kale | Regular cooking oil |

| Bottle of Wine (Mid-Range) | Lemons, Limes | Rice (of standard quality) |

| Bovine Meat (beef) | Lentils - dry | Salt |

| Breakfast cereals | Loaf of Fresh White Bread | Soybeans |

| Bulgur or couscous | Local Cheese | Spinach or other leafy green vegetables |

| Butter, Ghee | Maize (corn) flour | Starchy Roots |

| Cabbage | Mango | Sugar (Raw Equivalent) |

| Carrot or other non-green vegetables | Margarine | Sunflower Seed oil |

| Cassava | Melon | Sunflower Seed |

| Cereal flour | Milk (regular) | Sweet Potatoes |

| Chicken Breasts (Boneless, Skinless) | Mutton, lamb and goat meat | Tea |

| Chickpeas or other pulses - dry | Olives | Tofu |

| Coffee | Onions | Tomato |

| Cream - fresh | Oranges | Water |

| Domestic Beer | Other poultry meat (duck, goose, turkey) | Watermelon |

| Dried Fish | Pasta | Yam |

| Drinking water | Peach | Yoghourt |

| Eggs | Peas - dry |

Source: WageIndicator Cost-of-Living survey

Figure 3 Fish market San Salvador, El Salvador

Source: WageIndicator Foundation, Ⓒ Paulien Osse

2.2 Housing Costs and Utilities

Housing costs are almost always and everywhere the largest regular family expenditure. The standards of adequate housing depend on local conditions and therefore WageIndicator takes the cost of privately rented housing as the most realistic available option that is also acceptable in terms of decency. Data collectors are asked to record prices of housing that is not located in a slum or in an unsafe area. The housing needs to have permanent walls, solid roofs and adequate ventilation. Also, it has electricity, water, heating - if needed in that area - and sanitary toilet facilities. Individuals (without children) are assumed to rent a studio/ one-bedroom home and households with children are assumed to live in a rented two-bedroom home.

Table 3 shows how participants in the Cost-of-Living survey report the monthly rent, the number of bedrooms and location of their apartments. The collected housing prices are checked for outliers. A typical rent in the lower part of the price distribution (at 25th percentile) and in the middle of the price distribution (median price) is included in the calculation. The rental price for a family (and/or individual household) refers to a typical rent for a two-bedroom apartment (one-bedroom apartment) in an average urban area, outside the city centre and not centrally located or up-market.

Table 3 List of housing items in the Living Wage data collection

|

How much is the monthly housing cost of a standard studio apartment in your city/region? |

| How much is the monthly housing cost of a standard 2-bedroom apartment in your city/region? |

| How much is the monthly housing cost for a single room in the shared apartment in your city/region? |

| Rent (applies to tenants only) |

| Mortgage payments (applies to owners only) |

| Taxes on dwelling |

Source: WageIndicator Cost-of-Living survey

If the housing in a region consists of predominantly rural dwellings, the housing costs reflect the average cost of such dwellings. If the region is predominantly characterized by urban apartments, the housing costs reflect the prices of such apartments. This allows comparing the rent for many countries and for regions within countries as well.

Utilities are an essential part of the items in the Living Wage data collection. For each housing type, it is defined what is included and what is not included in the cost (Table 4). Prices are also collected for what is not included in the cost. Utilities include electricity, heating, drinking water, garbage collection, cooking fuel, internet connection, routine maintenance and repairs.

Table 4 List of utilities in the Living Wage data collection

|

|

|

|

|

Source: WageIndicator Cost-of-Living survey

2.3 Transport Costs

Transportation is an important cost for households as most people commute for work and daily activities. The Living Wage assumes the use of public passenger transportation which is commonly available in most areas. Transportation expenses thus consist of the expenses for a monthly pass for the use of public passenger transportation in most places, thereby assuming that each household member must be able to buy such a card. In other areas the price of a one-way ticket to the nearest town in local transport is converted to a monthly amount.

Transport cost related to the job – for example for a taxi driver or rider - are collected within a special section of the Cost of Living survey, called : “Occupational related items”. These prices are used to calculate Living Tariffs for platform workers.

2.4 Drinking water

The monthly spending on drinking water for a family is collected in the Cost-of-Living survey. This cost is then proportional to family size and it is added as a separate component to the Living Wage.

2.5 Phone, internet

Possessing a phone is the norm and phone expenses are paid regularly hence it is important to include phone expenses in the calculation. Similarly, access to the Internet is part of the essential basic needs of families. The Cost-of-Living survey therefore includes the cost of a phone, the average price of a 60 minutes phone prepaid plan (no discounts) and the cost of a monthly mobile data plan (at least 3G speed).

The WageIndicator Living Wage includes the cost of a 60 minutes phone prepaid plan and the cost of a mobile data plan of at least 3G speed. Although the price of a phone is collected in the survey, it is for now only used to calculate occupational cost related items for platform workers.

2.6 Clothing

Clothing is part of the essential basic needs. The Living Wage data collection therefore collects information about clothing monthly expenditure for a family of four. These expenses are proportionally adjusted for family size. Thus, clothing expenses for an individual are assumed to be one quarter of the expenses reported for a standard family with two adults and two children.

2.7 Personal and Healthcare Costs

The Living Wage data collection includes the basic personal and health care expenses (personal care products and small pharmacy) for a family of four. These expenses are proportionally adjusted for family size. Thus, health expenses for an individual are assumed to be one quarter of the expenses reported for a standard family with two adults and two children.

In the survey, data is collected more specifically on personal and health care costs. If the country doesn’t have a free healthcare system, then the cost of the basic health insurance, covering one person and/or one person and the family is collected. Monthly expenses for period products, birth-control products, personal care products and household cleaning products are also collected.

2.8 Education Costs

Education in public schools is provided at relatively low cost, but additional costs are related to supplementary materials like books, pens, a bag and the fees. The Living Wage data collection therefore includes the minimal monthly expenses on children’s education, assuming children attend public schools. Based on the reported minimal expenses on education, the monthly expenditure on education is included in the Living Wage calculation, controlled for family size. The cost of education for adults is not included.

2.9 Unexpected expenditure

WageIndicator follows the usual practice by adding a 5 percent margin to the final estimate of the cost of living. The lower margin of 5 percent is more appropriate when the calculation of the cost of living is more comprehensive, while it does not increase the resulting Living Wage. This 5 percent margin is also used for the calculation of the Living Income, see Chapter 2.11.

2.10 Mandatory contributions and taxes

The Living Wage data collection assumes that taxes and contributions to social security are part of the essential basic needs. Therefore, one question includes the monthly taxes on dwelling. Additional information about monthly income taxes and contributions to social security are derived from country-level tables of taxes by income brackets and social security bracket.

3 Data collection

This chapter details the methods how prices are collected for the ten categories in the Living Wage data collection, as outlined in the previous chapter. The development of the collection since 2014 is sketched, followed by an explanation of the geographical granularity of the Living Wage data. Then the data collection methods are discussed, followed by details about the data collectors. Finally, the quality controls during the data collection are discussed.

3.1 The development of the Living Wage data collection

In October 2013, WageIndicator started the collection of prices. It seemed easy to post a teaser on all web pages, asking web visitors for the actual price of a single item. Daily the items in the teaser were changed so that after some time all items had been posted, see Figure 4 with an example from Paycheck in India. Web visitors who had entered a price, were asked if they were willing to key in the prices of other food items. This was the start of the Cost-of-Living survey. Items asking about the prices of housing, drinking water, transport, and clothing were added (Guzi, Kahanec, & Kabina, 2016).

Figure 4 Daily changing question in the online Cost-of-Living survey

See an example of the Indian WageIndicator website Paycheck.in. The green banner is dedicated to the price of butter/ghee in “your area”, followed by a question in which area the web visitor resides.

Source: WageIndicator website PayCheck.in in India

The Cost-of-Living survey was translated in the national languages of the national WageIndicator websites, and then posted on these websites. By 2015, the Cost-of-Living survey was offered in 84 countries. In 2023 the Cost-of-Living survey was offered in 186 countries and 61 languages (see Annex 2). When price data is not sufficient or reliable, WageIndicator does not calculate an estimate.

Since its start, the number of items in the Cost-of-Living survey has been rather stable. In 2016 drinking water and clothes were added. In 2021 an extra section ‘Occupational costs-related items’ was added. These items are only used to calculate Living Wages/Tariffs for companies in the platform industry. WageIndicator develops a Living Tariff for workers in the platform industry, as is further detailed in Annex 8.

Over the years the dataset grew. Table 5 shows that the number of countries with a Living Wages data collection increased from 45 in 2014 to 148 in 2023. In 2019, WageIndicator started quarterly releases. The table below shows the number of countries for the October releases (apart from 2023 where only the first release could be presented). From 2022 WageIndicator can state: half of the countries are low and lower-middle income countries in Africa, Asia and Latin America. Figure 5 and Annex 6 show these countries.

Table 5 Number of countries with a Living Wages data collection since 2014 for at least one quarter (More detail, see Annex 6 for full year data collection)

|

Year

|

2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Countries | 45 | 48 | 57 | 64 | 48 | 75 | 114 | 130 | 142 | 148 |

Source: WageIndicator Living Wages data collection.

Figure 5 Countries with a Living Wage data collection by October 2022

Source: WageIndicator Living Wages data collection.

3.2 Geographical granularity of the data

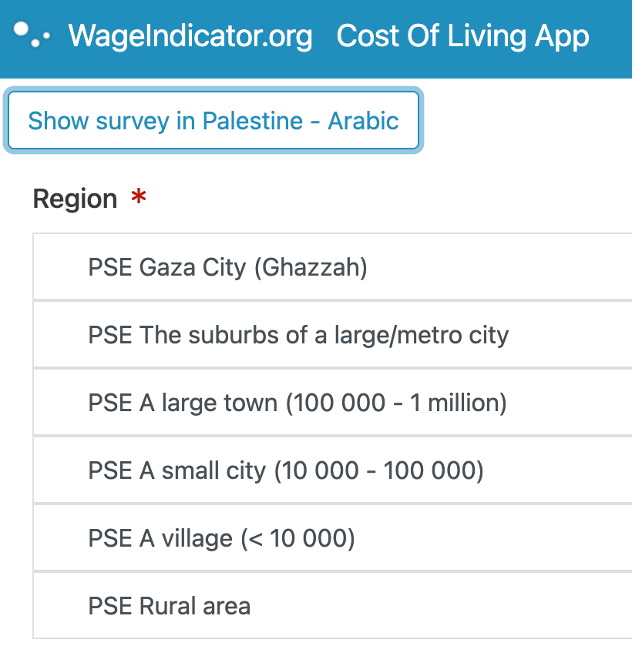

Prices of consumer goods vary largely across as well as within countries. This challenges the question to the extent of the geographical granulation of the Living Wage data collection. Already in the 2000s WageIndicator had developed a database with geographical entries for its Salary Survey and then for other apps and web-tools as well, such as the Cost-of-Living survey. This so-called ‘Region API’ serves the Cost-of-Living survey respondents to identify their region before reporting prices of goods and services as shown in Figure 6. API is an abbreviation for Application Programming Interface and is a piece of software that makes a database accessible, in this case a database with the names of regions and cities for countries worldwide.

Figure 6 Screenshot of the region question in the Cost-of-Living survey, showing for the USA the list of states, and after selecting Georgia, showing the choice of cities in this state

Source: WageIndicator Cost-of-Living survey

The Region API allows web visitors, data collectors and other users to easily identify where they live or where they collect data. As of 2023, the Region API covers 234 countries, and specifies provinces/states/counties within these countries, the so-called level 1 regional entities, shown in grey in Figure 6. Once a province/state/county is selected, a second level allows for selecting cities, villages, or rural areas, shown in blue in Figure 6. In some provinces/states/counties the second level does not include all cities, as the list would become too long. In these cases only the large cities are listed and for the small cities or villages the choice is offered for selecting ‘A small city (10,000 - 100,000)’ or ‘A village (less than 10,000)’, as Figure 6 shows. The label set of the Region API is downloadable (see Annex 12).

In 2021, WageIndicator started a process to make sure that all names of all provinces/states/counties in the Region API reflect the most recent administrative divisions and can be mapped in common data visualisation programs like Google Data Studio and Tableau. Early 2023 this process is more than half way through.

The Region API allows to specify prices to a high degree of geographical granularity. Computing Living Wages assumes enough price observations in an area. Therefore, the most applied granularity is at the first level of the Region API, hence for provinces/states/counties. If the number of price observations at this level are not sufficient, the provinces/states/counties are clustered into four groups, the so-called Region cluster groups 1 to 4. A cluster is a group of provinces which are aggregated according to the size of the population of the largest city in the province.

The geographical granularity of the Living Wage data of course depends on the resources to collect price data. Over the years, WageIndicator succeeded in collecting more price data and therefore could provide Living Wages for more provinces/states/counties. In case of small countries or in case of insufficient data points, the Living Wages are presented for the entire country only. As of 2023 WageIndicator provides national and regional Living wages for 148 countries and 2093 regions. Within some regions, WageIndicator can present urban and rural data: 1166 regions come also with urban data, 1236 regions present rural data. The presentation of urban / rural data is not meant for implementation, since this type of granularity cannot be guaranteed each quarter and each year, but this data helps to understand the benchmark better. For example, city level estimates are provided on demand. WageIndicator approach allows to calculate the Living Wage estimate at city level but to guarantee quarter on quarter, year on year updating is costly.

3.3 Decentralised data collection, centralised data storage

The Cost-of-Living data collection is an app and web-based operation, whereby price data can be entered from any place in the world while the data storage is centralised. This approach is similar to all other WageIndicator data collections. The Cost-of-Living data collection falls apart in five modes, which will be discussed in this section:

- the Cost-of-Living web survey, posted on national WageIndicator websites

- the Cost-of-Living survey app, used for face-to-face data collection, both by interviews and by price observation in markets and shops

- the Cost-of-Living survey webshop app, used for data entry from prices collected from webshops

- the Cost-of-Living survey print, used when the survey app cannot be used

- data from external sources

3.3.1 The Cost-of-Living web survey

The Cost-of-Living web survey is posted on all national WageIndicator websites, as shown in section 3.1. WageIndicator websites draw millions of visitors annually, attracted by valuable information about wages in context, labour law, and careers, which is generally not easily available elsewhere. This is supported by profound search engine optimization. On a daily basis the survey pushes a banner to each web page of a national WageIndicator website, eliciting web visitors to enter the price of one food item in the Cost-of-Living survey, as shown in Figure 10.

3.3.2 The Cost-of-Living app

The Cost-of-Living web survey was made available in the Cost-of-Living survey app, used for face-to-face interviews about prices and for data collectors registering relevant food prices in shops and markets. Of course, the survey questions are identical to the web survey. The app can be used on a telephone, a tablet as well as a desktop computer. The main advantage of the app is that data collectors can key in the data while being offline, which is important in areas where mobile internet or wi-fi isn't always available or is very expensive. A second advantage of the app is that it gives access to all countries/languages where the survey is available. Hence, the Cost-of-Living survey app can be answered in English and Arabic in Palestine, for example, as Figure 7 shows. The app has options for more than 186 countries and 61 languages. The app requires data collectors to identify the country for which the data is collected. By doing so, the currency and the region questions are aligned for this country (see Annex 2 for the URL).

For some countries data collectors can opt for more currencies. In Zimbabwe, US Dollar, South African Rand and the Zimbabwean Dollar are the options. In Lebanon, Lebanese Pound and US Dollar are the options. For El Salvador and Venezuela, options of more currencies are still in debate within the technical team of WageIndicator.

Figure 7 Selection of country and region

Source: WageIndicator Cost-of-Living survey

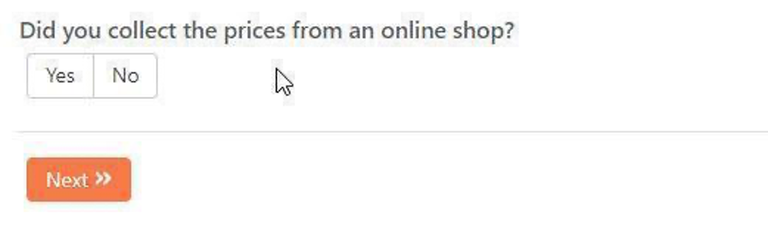

3.3.3 Cost-of-Living survey for webshops

Webshops - simple and complex - have largely entered into the lives of many inhabitants worldwide, thereby offering a new outlet to collect price data. Based on the Cost-of-Living survey app, a special feature was developed for collecting data from webshops. The Cost-of-Living survey app was extended with an extra question whether the data collector had accessed a webshop to collect price data, as Figure 8 shows.

Figure 8 Extra question for digital collectors at the https://costofliving.wageindicator.org/

Source: WageIndicator Cost-of-Living survey

Due to the Covid 19 pandemic, face-to-face methods of surveying proved to be challenging and WageIndicator decided to update food prices partly based on data collected from the cheapest webshops (Table 9 and 10). If a country had no webshops, also not after double-checking with a national WageIndicator contact, data collection for the country would move to face-to-face data collection (Korde et al., 2021).

Whereas shops and markets have prices for just one locality, webshops can sometimes set prices for larger areas, ranging from a city to a province or even an entire country. Webshops are therefore classified according to the number of provinces/states/counties they serve, and the prices collected from the webshop apply to these regions.

3.3.4 The Cost-of-Living Survey face to face via an app or in print

By January 2023 55 countries bring in data via face to face data collection. Part of that is via print, part directly keyed in in the app at the cell phone or tablet. In 2023 the data collection is for more than 90 percent financed out of sales of data.

From the start of the Cost-of-Living survey, projects have facilitated the data collection. The first was the Living Wage Eastern Africa project, which ran from 2012 till 2016. WageIndicator trained 70 shop stewards in price data collection and in a meeting in Ethiopia participants were asked about the costs of living, using a print version of the Cost-of-Living survey (Van Norel, Veldkamp, & Shayo, 2016). For the project Wages in Context in the Garment Industry in Asia (2015-2016) price data was collected using the print survey for nine Asian countries (van Klaveren, 2016). In a project studying the global cut flower industry the floriculture or agricultural sectors of Kenya, Ethiopia, Uganda, Colombia, and Ecuador the gaps existing between statutory minimum wages and/or average wages and living wages turn out to be wide. Overall and based on recent data calculated for 2020-2022, gaps vary between 43 and 493 per cent (Van Klaveren & Tijdens, 2022).

Also in recent years data collectors find it sometimes easier and safer to use a print version, as Figure 9 shows. Obviously print has the disadvantage that data must be keyed into the Cost-of-Living web survey or in the app afterwards. This is extra work and it increases the risk of data entry errors. Some data collectors find it helpful to collect data by means of pictures of food prices, taken at markets or shops, and key in the prices afterwards.

Figure 9 Data collection in Richard Toll, Senegal

Source: WageIndicator Foundation, Ⓒ Paulien Osse

3.3.5 Data collection from external sources

The Living Wage data collection is complemented with data from external sources. This concerns the following data:

- World Food Programme for data on food prices

- Numbeo data for prices regarding housing (69 countries), as well as some food data.

- Data from national statistical agencies for information regarding health cost, phone cost, and education cost.

3.3.6 Prices from (super)markets and (open) markets in low to lower-middle income areas

As detailed in Chapter 1, a Living Wage must be an income necessary to provide workers and their families with the basic necessities of life. For the Cost-of-Living survey this implies that prices are collected from shops and markets in low to lower-middle income areas, including housing prices and utilities of these areas. Data collectors are trained in how to collect prices at the cheapest supermarkets or open day markets. When collecting prices from webshops they are told to avoid webshops where prices are in US Dollars (unless it is in countries where the USD is the national currency). Some food items in the Cost-of-Living survey explicitly refer to a basic quality, thereby excluding luxurious items.

Regarding housing prices, it is obvious that prices given by Airbnb, Booking or any other hotel site are not acceptable. Data collectors are trained to research and understand to what extent the housing market is online or offline in the country and adapt the data collection accordingly. They are trained to avoid expensive rental websites in regions where houses are rented through local house brokers or available through housing subsidy schemes (for poorer regions). If the rent is given on a weekly basis, data collectors will convert it for a month as required in the survey.

3.4 The data collection process for the Cost-of-Living survey

3.4.1 The data collectors for the Cost-of-Living survey

Data collectors are critical for the success of the data collection of prices. As the number of countries with a Living Wage calculation has increased over time, so have the number of data-collectors. Data collectors are organised in teams covering regions, language groups, parts of continents, with one or more team managers. Managers call in local experts where needed. They oversee the data collection processes, train the data collectors, and provide feedback. Since 2019 WageIndicator has a permanent relationship with FLAME University in Pune, India. WageIndicator offers internships to max. 150 students per semester for students from FLAME. In addition, WageIndicator hosts interns from Kassel and Berlin University, University of Amsterdam, Bucharest University and two intern platforms, The Intern Group and Virtual Internship. All interns do price data collection next to a topic of their expertise like News and Web Content, Social Media, Growth Marketing, Data Visualization and Business Analytics, Management, and Gig Economy.

In addition, WageIndicator hires for 55 countries qualified individuals - in half of the cases related to specialised data collection bureaus - as data collectors. The data collectors collect price data from local citizens, open markets, supermarkets.

Table 6 provides an overview of the persons involved in the Cost-of-Living data collection, totalling to over 265 individuals engaged in the data collection. Each quarter of the year these data collectors collect data in the Cost-of-Living app for the same countries and regions. Of course, they collect data for countries they are familiar with, regarding the language and culture, or where they have relatives living.

According to our experience we find that the richer the country, the more the data collection can be done online.

Table 6 Persons involved in the Cost-of-Living data collection in 2022 - in one quarter

| Continent | WageIndicator Team | Trained interns | Interview mode | |

| Africa | Africa - English | 17 | face to face | |

| Africa - French | 18 | face to face | ||

| Africa - Portuguese | 5 | face to face | ||

| Africa - North / Middle East | 12 | face to face / online | ||

| Americas | USA & Canada | 50 | online | |

| Central- and Latin America | 17 | face to face / online | ||

| Asia | China (only local data collectors) | 35 | face to face | |

| India (only local data collectors) | 50 | face to face / online | ||

| Asia other * (interns from all Asian countries) | 12 | face to face / online | ||

| Russia /Kazakhstan /Belarus /Ukraine | 3 | face to face / online | ||

| Europe | North | 6 | 10 | online |

| South | 4 | online | ||

| Europe East / Balkan | 14 | face-to-face / online | ||

| Oceania | Australia | 6 | online | |

| New Zealand | 6 | online | ||

| sub Total | 143 | 122 | ||

| Total in one quarter | 265 | |||

Source: WageIndicator Living Wage Data collection

3.4.2 Characteristics of the data collectors

All data collectors recruited by WageIndicator have at least a bachelor degree. All are trained. All interns are screened and checked for a minimum internship of at least two months full-time, but usually it is 6 months. Team members of WageIndicator, who are involved in the data collection, are always involved for more than a year, and many of them are with WageIndicator for 6 years or more, as Table 7 shows. They are educated as economists, sociologists, or journalists. An overview of the interns can be found here.

Table 7 Characteristics of the data collectors in 2022 per quarter

| Persons* | Regions | Training | Experience | ||

| 1 | Interns during one year | approx. 150 interns | Usually countries where English is the main language | 2 hours training, and weekly update of 20 minutes | Minimum 2 months |

| 2 | WageIndicator team members during one year | 143 team members; of which most of them are specialised data collectors | Mainly countries where the internet is not widely used. Mainly countries where English is not a language frequently used, | Written instructions, instruction videos, and quarterly feedback quality updates | From 2 till 6 years |

| 3 | Web users WageIndicator national websites | 9,726 users in 2021 and 4,436 users in 2022 | Medium/high income countries | No training, if the website isn't good, users will not leave price data behind | na |

3.4.3 Instructions and training for the data collectors and quality controls

In several ways, WageIndicator provides online training to the data collectors, via Zoom, WhatsApp or their preferred (and safest means of communication), in written instructions, instruction videos, and quarterly feedback quality updates by the team managers. Most data collectors get the different types of training and are in touch on daily basis with the global team. Table 7 provides an overview of the training provided.

All data collectors get the same instructions and training, whether it is for collecting data from webshops, or face-to-face and then keying in the data in the Cost-of-Living survey app. The collectors are trained by the following rules:

- Understanding the survey

- Understanding the uploading process

- Select areas where to collect data in relation to low, lower-medium income, not posh, up-market areas

- Avoid the poorest area, where possible

- Go to areas where workers live, so not the coolest city centre, tourist or expat area

- Collect food and housing prices by interviewing people, selected via random walks (“Go straight, take the second left street”)

- Select your respondents randomly

- Take time to talk your respondents while following the survey

- Collect food prices at the market/shops, to be selected via random walk

- Collect housing prices regarding decent housing (safe, solid roof, water, electricity, heating, sanitary toilet facilities)

- Collect housing prices from real estate agents, to be selected via random walk

Here are some experiences from the data collection process:

- Sometimes it is better not to use a smartphone, but a printed survey

- Interview in pairs - more efficient and faster than doing it all as an individual.

- Some countries report that women are better trained to talk about prices with women, men are better at talking about prices with men, but it is felt that the latter report higher prices.

- Gender-mixed teams seem to be the best

- Data collectors usually know that the price is collected to calculate Living Wages, yet data collectors are trained not to tell their respondents that the prices are collected to calculate Living Wages

- If extra data is needed for a client of WageIndicator, the name of the client is not shared with neither the data collector nor the respondent.

On a daily basis the team managers check the data collected. Specifically, the housing prices are cross checked across the different surveyor groups operating simultaneously (Korde et al., 2021).

All data collectors have a unique pin code related to their name and email address. Without the code they can't upload the collected data. Each price in the database can be traced back to an individual data collector.

Obviously the pin code does not count for web users who key in data on the basis of a request as described in Figure 4. In general, web users key in one price only.

Lastly, all data collectors have undergone a safeguarding training and adhere to WageIndicator’s Code of Conduct.

3.5 Quality controls

The Cost-of-Living application collects prices continuously. WageIndicator updates Living Wages each quarter to keep up with changing price levels. The quality of national and regional Living Wages is rated internally by assigning a Stability and Data Quality Code to each country and region, based on a comparison with the data for the same country/region from the previous quarter. Data fluctuations are tracked since January 2019. When a >10 percent change is observed, a thorough check on that country's data to see if there is an issue in any of the components. If an issue is found, it is corrected in the script and the Living Wage is recalculated. Table 8 shows the levels and frequency of quality checks.

In addition, Living Wages are checked for consistency over time. In case structural discrepancies are detected, WageIndicator consults national experts to analyse and correct the source(s) of bias.

Feedback on methodological questions and the quality of Living Wages is also obtained through discussions in webinars (see Annex 6), involving academics, employers, trade unions and data collectors.

In relation to clients (MNEs and NGOs) who use the Living Wage database, improvement activities are ongoing. Some clients check each quarterly release with HR or Compensation and Benefits departments worldwide and report back. In other cases data collectors report back.

Table 8 Levels and frequency of quality checks

|

Quality checks |

yearly | quarterly | daily |

| Survey | |||

| Survey correct - does it produce the correct data from the correct country / region | x | ||

| Survey correct - new countries / item language / translation checks | x | x | |

| Survey - region / city - correct | x | x | |

| Survey items still relevant | x | ||

| Data collection | |||

| Data collectors - recruiting / screening | x | ||

| Interns - recruiting / screening | x | ||

| Data collectors training | x | ||

| Interns training | x | x | |

| Assign extra data collectors - they don't know each other - in one country. (f.e. face to face and online) | x | x | |

| Feedback | |||

| Feedback during data collections process | x | ||

| Feedback on the basis of estimates for all data collectors | x | ||

| Feedback from all clients on the basis of estimates | x | ||

| Data process | |||

| Check for outliers (not above or below a defined number) | x | ||

| Check for currency mistakes | x | ||

| Check for relation between quarters | x | ||

| Check for relation with World Food Programme database | x | ||

| Check for relation with Numbeo data | x | ||

| Check for the relation between the components | x | ||

| Check the relation between housing and Minimum Wages (if MW is adjusted for that country) | x | ||

| Check for tax and social security updates | x | x | |

| Update inflation (from 2022 twice a year) | x | ||

| Double check | |||

| Calculations of family-types | x | ||

| Year averages | x | x | |

| Comparison quarters / stability over quarters | x | ||

| Minimum Wages | x | ||

| Check requests from clients (MNE / NGO / Trade Union / web users) | x | x |

Source: WageIndicator Living Wage Data Collection

3.6 Sampling bias in the data collection?

This section details WageIndicator’s data collection strategies:

- For the data collection of prices from shops/markets, the sampling frame consists of shops/markets located in low-income areas, because the Living Wage data collection aims at the lowest prices for the defined food basket. The shops/markets are sampled by random walks in these areas. WageIndicator data collectors go to these shops/markets and register the prices, similar to what mystery shoppers in retail establishments do. Hence, the data collection of food prices is not based on shop-owners' reporting of prices. This data is collected by WageIndicator data collectors using the Cost-of-Living app.

- For the data collection of prices from webshops, the sampling frame consists of all webshops that can be found online in the selected region/city, and the sample consists of the webshops with the lowest prices for the selected food basket; this data is collected by WageIndicator data collectors using the Cost-of-Living app.

- For the data collection of housing prices from the respondents responding on behalf of their households, respondents’ locations are selected in low-income areas and in a next step based on randomly asking people in streets; this data is collected by WageIndicator data collectors using the Cost-of-Living app.

- For the data collection of housing prices from real estate agents, again the low-income areas are selected and as many estate agents as possible are visited; this data is collected by WageIndicator data collectors using the Cost-of-Living app.

- For the data collection of prices from web visitors of the more than 200 national WageIndicator websites on work and wages, the Cost-of-Living web survey in their national languages is used. Here no sampling frame exists as the data collection is based on a non-probability web survey.

- For the data collection of food and housing prices, data from external sources are added, when available and when assessed to be reliable.

Are these data collection methods prone to sample bias? In an ideal world, it would always be possible to use statistically sound sampling techniques to produce price indices with a high degree of accuracy and within given resource constraints. However, price data collection does not take place in an ideal world. When prices would be collected solely by means of household expenditure surveys, a high-quality sampling design could be applied, in most countries including the identification of low-income strata. However, measurement errors are likely as respondents may not adequately remember the prices of the selected food items or may not know the prices of some items. When prices are sampled from establishments (shops/markets), in many countries enterprise sampling frames are incomplete or missing. However, measurement errors are likely to be small as the prices are directly observed by the data collectors. When prices are collected from volunteer web visitors, they are not urged to report the lowest prices but to report the prices they paid today or yesterday. The latter price data collection can be prone to selection bias. As will be shown in Table 9 in Chapter 4, some 8 percent of the total data set originates from web visitors. WageIndicator assesses the possible bias of this data in the total sample as small, because the large majority of data is collected by data collectors.

4 Calculation of Living Wages and Living Income

The two preceding chapters are dedicated to the Living Wage, Living Income items and the data collection. This chapter focuses on the calculation of the Living Wage and Living Income. It details the data streams in the Living Wage data, the assumptions underlying the Living Wage calculations, the components of the Living Wage calculations, and the features of the Living Wage dataset. The last section shows the Living Wage estimates for a selection of five countries.

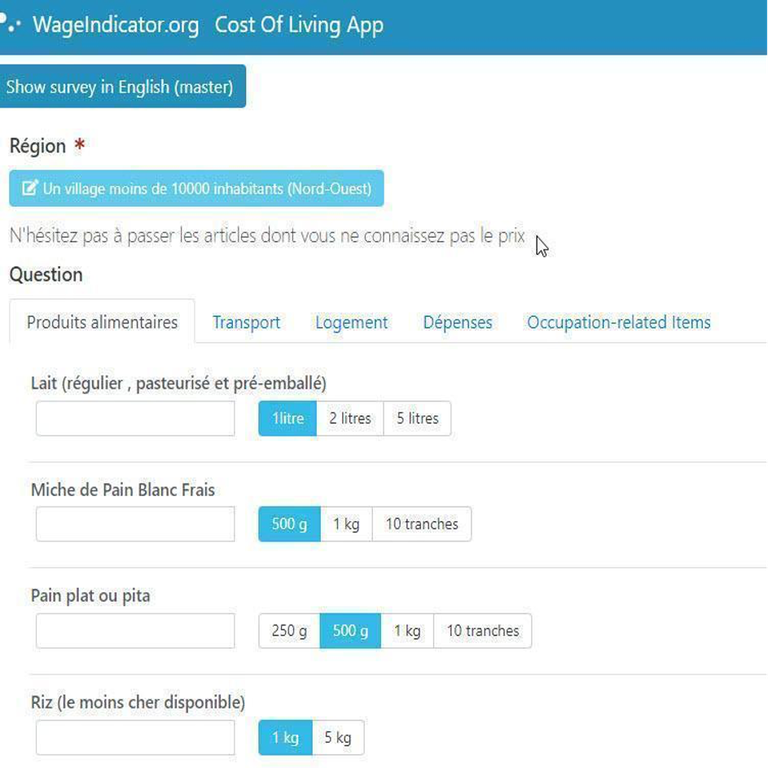

4.1 The Cost-of-Living database

4.1.1 The Cost-of-Living database

The price data in the Living Wage database are collected by means of the app / web-based Cost-of-Living survey. The screenshot of the survey in Figure 10 shows that the data collectors can select a category for which they want to enter prices, be it of food, transport, housing, expenses, or occupational cost-related items. The survey is always presented in a national language and a language switch to English is facilitated. The region is selected based on the locality of the interviewer, but can be changed depending on the region where the data is collected. For each item, a price can be keyed in and its pre-set unit appears automatically. data collectors can opt for keying in just one or few items if they have not (yet) collected the prices for other items.

The data collected in the Cost-of-Living survey result in a huge dataset. A codebook is available regarding the variables in the dataset. The codebook consists of:

- value labels of the item ids in the Cost-of-Living survey, see Annex 8;

- value label of the unit ids in the Cost-of-Living dataset. The unit id’s have been stable over the years; the units are presented both in the app and in the online Cost-of-Living survey, see Annex 9;

- variable labels in the Cost-of-Living dataset, see Annex 10.

Figure 10 Cost-of-Living survey structure

Source: WageIndicator Cost-of-Living survey

4.1.2 WageIndicator data streams and data generating devices/sources.

The number of price observations in the Living Wage database is huge. Currently, the database includes information from different sources for over six million prices, gathered since 2014. In 2022, 671,170 prices (primary data) were collected using the WageIndicator Cost-of-Living web survey and app with 96 percent of that being collected by trained data collectors . As described in Chapter 3.3, the prices in the Living Wage database stem from five sources, namely, from the Cost-of-Living web survey, the Cost-of-Living survey app, the Cost-of-Living survey webshop app, the Cost-of-Living survey print, and external sources. Table 9 and 10 depict how the data is distributed over the first three categories used in the January 2023 release of living wages.

Table 9 Tracking data streams from different WageIndicator platforms - January 2023

| Platform used | Data collector | % of total collected prices | Source traceable in dataset | |

| 1 | Data via WageIndicator website - online Cost-of-Living survey | Mainly generated by web users, rarely by trained data collectors | 8% | yes |

| 2 | Data via Cost-of-Living survey app | Collected by trained data collectors who use a mix of face-to- face, WhatsApp and Facebook groups, interview techniques and webshops | 92% | yes |

Table 10 Tracking data streams from different sources

| Source | Data collector | % of total collected prices | Source traceable in dataset | |

| 1 | Data from webshops* | Collected by trained data collectors only | 57% | yes |

| 2 | Data from regular shops /face to face surveys | Generated by web users and by trained data collectors | 43% | yes |

*those who selected the “internet shop” question as shown in Figure 8

The external sources are predominantly data from the World Food Program, Numbeo housing prices as well as the Numbeo food prices and data from National Statistical Offices.

The Living Wage data collection is based on a sound IT system for centralised data collection that ensures stable data collection over time and across countries. Well-developed scripts are used to call for the data from external sources.

4.2 Assumptions underlying the calculation of a Living Wage

The Living Wage calculation includes a set of assumptions, namely:

- a Living Wage is calculated for adults who are of economically active age and competent to manage their family budget efficiently;

- individuals without children rent a one-bedroom home and households with children rent a two-bedroom home;

- individuals and families for whom the Living Wage estimates are most relevant are assumed not to own a motorbike or car and therefore need to rely on other means of transportation, usually public transport; children of such families commuting to schools can travel for free or with a substantial discount;

- all family members are in good health;

- meals are prepared at home and ingredients are purchased from supermarkets or at markets in the lower price range;

- expenses on clothes and footwear are accounted for;

- a phone tariff of 60 minutes per month per adult is included;

- housing expenses refer to houses or apartments that are not centrally or up-market located and not located in a slum or an unsafe area;

- adequate housing is assumed to have permanent walls, solid roofs, adequate ventilation, and has electricity, water, heating - if needed in that area - and sanitary toilet facilities. Where possible, costs related to heating, electricity, and water consumption are calculated apart from housing costs;

- a ‘normal’ working week is assumed. This ‘normal’ working week, which differs per country, should not be more than 48 hours maximum (ILO Convention 1 of 1919);

- a Living Wage is the monetary equivalent of the regular income, including any regular in-kind provisions;

- a Living Wage is the regular monthly income from labour; irregular or incidental income is assumed to be used for extraordinary expenses;

- a Living Wage is estimated for employers who (should) pay the local Living Wage voluntarily, unless contracts are made with workers groups, trade unions and/or buyers;

- the calculation of WageIndicator Living Wages only includes basic expenses and is therefore applicable to all countries;

- a Living Wage reflects the local living standards and needs of workers and their families;

- a Living Wage is calculated as a reference income of a full-time worker in gross terms.

WageIndicator collects and calculates Living Wages following the same principles adopted by other Living Wages campaigns. The methodology to calculate Living Wages is consistent with some previous Living Wage campaigns reviewed in Anker (2011). The methodology is versatile and can be applied in all national and regional settings. The resulting comparability of the data collected forms the basic condition for the calculation of Living Wages that are consistent globally and over time.

4.3. Living Income

The Living Income benchmark is relevant for (small) farmers/farming households. Yet, it may be applied just as well to all households where income earners are self-employed in their own business - which is usually a small-scale family enterprise, similar to smallholders.

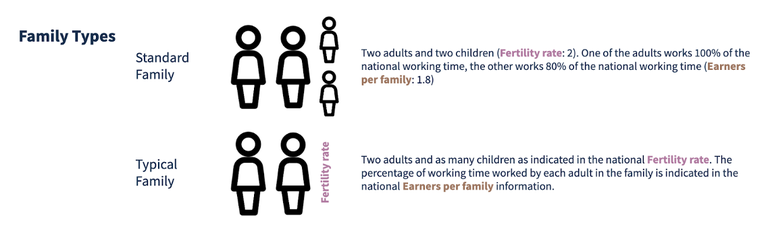

The assumptions for a Living Income are the same as for those Living Wage earners at a payroll, but there are some differences. The Living Income benchmark accounts for the cost of essential necessities in a household, varying with the region and country where they live and work. Thus the Living Income benchmarks offered by WageIndicator reflect the needs of a typical national/regional household. A typical household is assumed to consist of two adults, plus the number of children (from one woman) as derived from the national fertility rate of a country given in the World Bank database (2016-2020). In this respect, WageIndicator extends the practice of basing calculations on the standard family of 2 (adults) plus 2 (children), by allowing for variation in family sizes and estimating Living Incomes which more accurately depict varying living requirements.

To resume the definition, a Living Income is the amount of money a household must earn to achieve a decent standard of living. This income must be earned by the two adults in the family only (the income earned by minors, i.e. children under 16, is excluded from the calculation of the Living Income benchmark). The Living Income is therefore made up of all the diverse sources of income that a household may receive through the labour of two working adult members. It is assumed that in this household both adults work the full working week. Their combined income should be sufficient to cover the costs of the indispensable necessities that their household needs for a decent living.

The indispensable items are similar to the elements making up the cost of living used to arrive at a Living Wage, i.e.:

- Food

- Drinking Water

- Housing

- Transport

- Phone and internet

- Clothing

- Health

- Education

- Unexpected expenses

See for a detailed overview of these necessities paragraphs 2.1 - 2.9 above.

The other main difference with the Living Wage is that the Living Income includes taxes and social security contributions that are normally due by the employer (thus excluded in the Living Wage calculation). Since the two working adults are not employed (have no permanent employers) the part of social security premiums and taxes normally paid by employers on behalf of their employees must be borne by these working adults themselves, so the Living Income calculation must include the equivalent of these extra costs the self-employed household/family business has to pay. Therefore, WageIndicator’s calculations also include the taxes and mandatory contributions that the typical household must make as part of their business venture (the part that would otherwise be borne by an employer).

This information is updated twice a year by the WageIndicator team through desk research.

For a better understanding and examples of the Living Income calculations, check Table 12.

4.4 The six components in the Living Wage data

The calculation of the Living Wage is composed of six components, notably food, housing, transportation, health, education, and other expenses (e.g. clothing, personal care). The following is an explanation of how each component of the Living Wage is calculated.

4.4.1 The calculation of food costs

Food expenditure is crucial in estimating the Living Wage. WageIndicator calculates the food costs using two data sources. The first is the WageIndicator Cost of Living Survey, which is explained in detail in Chapter 2 and which collects the actual prices of 68 food items. The second is the UN Food and Agriculture Organisation (FAO) food balance sheet, which presents the consumption of 81 food items measured in kilocalories and in grams per person per day and reflects the food preferences in a country. Two examples of this for Vietnam and Ghana are presented in Annex 11.

To ensure that the differences between food consumption patterns amongst countries are incorporated in the calculation, WageIndicator calculates the food basket for a model diet for each country based on the data from the FAO Food balance sheet. To avoid the negative bias in the quality of the food basket in low income countries and to make sure the country-specific food consumption is balanced with the provisions for a healthy diet, the basket is checked against the balanced diet defined by the World Health Organisation (WHO). WHO defines a balanced diet to comprise less than 30 percent of calories from fats, less than 10 percent of calories from free sugars, less than 5g of salt per day and at least 400 grams of vegetables and fruits per day (WHO, 2020). To make the FAO Food balance sheet comply with the WHO provisions, the following adjustments are made when creating the WageIndicator food baskets:

- Fats, Animals, Raw - adjusted to 0%

- Pig meat - adjusted to 60%

- Milk - Excluding Butter - adjusted to 50%

- Oils - adjusted to 50%

- Sugar - adjusted to 60%

- Fruits and Vegetables - increased to 400 grams for countries with intake less than 400 grams/person/day.

WageIndicator has a tolerance of 5 percent for the total percentages of fats and sugar.

The following Table 11 shows the WageIndicator food baskets for model diets for Ghana and Vietnam, 2022.

Table 11 Example: food basket calculation in Ghana and Vietnam, 2022

|

Item |

Ghana | |||

| Food supply (kcal/capita/day) | Percentage Protein supply quantity (kcal/capita/day) | Percentage Fat supply quantity (kcal/capita/day) | Price per kilo (USD) | |

| Wheat, barley and cereals | 207.1 | 1.11% | 0.48% | 2.36 - 3.68 |

| Maize and products | 145.1 | 0.73% | 0.67% | 0.06 - 0.06 |

| Potatoes and products | 0.66 | 0.00% | 0.00% | 0.01 - 0.01 |

| Cassava and products | 453.77 | 0.70% | 0.19% | 2.05 - 3.28 |

| Sweet potatoes | 7.26 | 0.01% | 0.01% | 0.05 - 0.08 |

| Roots, Other | 43.53 | 0.14% | 0.02% | 2.06 - 2.99 |

| Yams | 280.31 | 0.85% | 0.24% | 0.83 - 0.83 |

| Sugar (Raw Equivalent) | 77.83 | - | - | 0.41 - 0.45 |

| Beans | 36.28 | 0.45% | 0.08% | 0.17 - 0.21 |

| Peas | - | 0.00% | 0.00% | 0 - 0 |

| Pulses, Other and products | 4.62 | 0.06% | 0.01% | 0.13 - 0.17 |

| Soybeans | - | 0.00% | 0.00% | 0 - 0 |

| Groundnuts (Shelled Equivalent) | 66.61 | 0.41% | 2.34% | 0.49 - 0.66 |

| Seeds and kernels | - | 0.00% | 0.00% | 0 - 0 |

| Olives (including preserved) | 4.62 | 0.01% | 0.17% | 0.35 - 0.46 |

| Sunflower Seed Oil | 22.42 | 0.00% | 1.09% | 0.13 - 0.15 |

| Oils (soy bean, olive, palm) | 96.95 | 0.00% | 4.66% | 0.46 - 0.52 |

| Tomatoes and products | 7.26 | 0.07% | 0.03% | 1.24 - 1.62 |

| Onions | 4.62 | 0.02% | 0.01% | 0.43 - 0.56 |

| Vegetables, Other | 4.62 | 0.04% | 0.02% | 0.14 - 0.38 |

| Oranges, Mandarins | 11.87 | 0.03% | 0.05% | 1.75 - 2.39 |

| Lemons, Limes and products | - | 0.00% | 0.00% | 0.07 - 0.11 |

| Bananas | - | 0.00% | 0.00% | 0 - 0 |

| Plantains | 201.16 | 0.34% | 0.20% | 3.32 - 3.32 |

| Apples and products | 0.66 | 0.00% | 0.00% | 0.04-0.07 |

| Coffee and products | - | 0.00% | 0.00% | 0 - 0.01 |

| Tea (including mate) | - | 0.00% | 0.00% | 0.05 - 0.06 |

| Bovine Meat | 25.06 | 0.43% | 0.74% | 0.98 - 1.98 |

| Mutton & Goat Meat | 6.6 | 0.09% | 0.23% | 0.31 - 0.66 |

| Pig meat | 80.46 | 0.57% | 3.20% | 1.43 - 1.72 |

| Poultry Meat | 38.91 | 0.66% | 1.16% | 3.18 - 6.21 |

| Butter, Ghee | 3.96 | 0.00% | 0.18% | 0.03 - 0.03 |

| Cream | - | 0.00% | 0.00% | 0 - 0 |

| Eggs | 2.64 | 0.04% | 0.08% | 0.14 - 0.18 |

| Honey | - | 0.00% | 0.00% | 0 - 0 |

| Fish products | 36.93 | 1.05% | 0.63% | 5.27 - 10.54 |

| Pelagic Fish | 5.28 | 0.14% | 0.10% | 0.21 - 0.3 |

| Rice | 203.14 | 0.73% | 0.15% | 2.38 - 2.91 |

| Milk – Excl. Butter | 9.23 | 0.09% | 0.10% | 0.16 - 0.24 |

| Total | 2,100.00 | 8.82% | 16.86% | |

| Total calories from free sugars = 3.71% of total calories | ||||

| Total vegetables and fruits per day = 541.07grams | ||||

| Salt is excluded from the diet | ||||

|

Item |

Vietnam | |||

| Food supply (kcal/capita/day) | Percentage Protein supply quantity (kcal/capita/day) | Percentage Fat supply quantity (kcal/capita/day) | Price per kilo (USD) | |

| Wheat, barley and cereals | 72.98 | 0.39% | 0.12% | 1.42 -2.41 |

| Maize and products | 77.08 | 0.36% | 0.30% | 1.01 -1.14 |

| Potatoes and products | 9.84 | 0.03% | 0.00% | 0.41 -0.55 |

| Cassava and products | 13.94 | 0.02% | 0.02% | 0.29 -0.37 |

| Sweet potatoes | 10.66 | 0.02% | 0.01% | 0.31 -0.45 |

| Roots, Other | - | 0.00% | 0.00% | 0 - 0 |

| Yams | - | 0.00% | 0.00% | 0 -0 |

| Sugar (Raw Equivalent) | 79.54 | 0.00% | 0.00% | 0.61 -0.73 |

| Beans | 13.94 | 0.17% | 0.02% | 0.19 -0.27 |

| Peas | - | 0.00% | 0.00% | 0 - 0 |

| Pulses, Other and products | 8.2 | 0.10% | 0.02% | 0.14 -0.19 |

| Soybeans | 46.74 | 0.77% | 0.78% | 0.35 -0.5 |

| Groundnuts (Shelled Equivalent) | 60.68 | 0.39% | 2.23% | 1.18 -1.48 |

| Seeds and kernels | - | 0.00% | 0.00% | 0 - 0 |

| Olives (including preserved) | - | 0.00% | 0.00% | 0 - 0 |

| Sunflower Seed Oil | 27.88 | 0.00% | 1.36% | 0.19 - 0.2 |

| Oils (soy bean, olive, palm) | 63.96 | 0.00% | 3.10% | 0.3 - 0.37 |

| Tomatoes and products | - | 0.00% | 0.00% | 0.02 - 0.02 |

| Onions | 4.92 | 0.04% | 0.01% | 0.34 -0.44 |

| Vegetables, Other | 89.38 | 1.01% | 0.34% | 10.84 -14.64 |

| Oranges, Mandarins | 5.74 | 0.02% | 0.01% | 0.68 -0.84 |

| Lemons, Limes and products | - | 0.00% | 0.00% | 0 - 0 |

| Bananas | 26.24 | 0.06% | 0.04% | 1.01 -1.41 |

| Plantains | - | 0.00% | 0.00% | 0 -0 |

| Apples and products | 1.64 | 0.00% | 0.00% | 0.3 -0.39 |

| Pineapples and products | 3.28 | 0.01% | 0.01% | 0.25 -0.3 |

| Coffee and products | 2.46 | 0.06% | 0.00% | 0.65 - 1.05 |

| Tea (including mate) | 1.64 | 0.09% | 0.00% | 0.67 -0.83 |

| Bovine Meat | 31.16 | 0.54% | 0.92% | 4.19 -5.82 |

| Mutton & Goat Meat | 8.2 | 0.11% | 0.29% | 0.75 -0.99 |

| Pig meat | 100.04 | 0.71% | 3.98% | 3.58 -4.03 |

| Poultry Meat | 48.38 | 0.82% | 1.44% | 3.41 -4.14 |

| Butter, Ghee | 45.1 | 0.04% | 2.10% | 1.2 -1.24 |

| Cream | - | 0.00% | 0.00% | 0.01 - 0.02 |

| Eggs | 13.94 | 0.22% | 0.43% | 0.66 -0.77 |

| Honey | - | 0.00% | 0.00% | 0 - 0 |

| Pelagic Fish | 6.56 | 0.18% | 0.13% | 0.72 -1.1 |

| Rice | 1,148.81 | 4.46% | 1.63% | 9.81 -11.86 |

| Milk – Excl. Butter | 27.06 | 0.31% | 0.41% | 0.71 -0.91 |

| Total | 2100 | 12.52% | 20.33% | |

| Total calories from free sugars = 3.79% of total calories | ||||

| Total vegetables and fruits per day = 564.66grams | ||||

| Salt is excluded from the diet | ||||

All WageIndicator model diets assume a daily consumption of 2,100 calories per person, which is the nutritional requirement for good health proposed by the World Bank (Haughton & Khandker, 2009). The model makes no distinction between adults, children, or pregnant or lactating mothers' food requirements. The principle that WageIndicator adheres to is that adults and children have 2,100 calories a day. In some cases children will eat more, sometimes less. Pregnant women might eat a bit more during the last months of pregnancy and the lactation period. The food costs calculation assumes that the food is prepared at home and purchased at the lower prices from supermarkets.

The data collectors are provided with detailed instructions on how to report the prices for the food items. These include instructions such as to exclude wrapping when reporting the costs and indicate the quantities precisely. More instructions can be found in chapter 3.4.3.

4.4.2 The calculation of housing costs

Housing costs are the most peculiar kind of costs because dwellings differ and local prices show substantial variation. The calculation of housing costs should therefore take into account quality criteria and depart from a minimum acceptable housing quality (e.g. appropriate number of rooms, location). In the WageIndicator Cost-of-Living survey respondents are asked about their house rents; they self-identify whether electricity, water, garbage collection, Internet, and taxes on housing are included in the rents reported. Respondents also indicate the size and location (inside or outside the city centre) of their apartments or houses. External data from Numbeo (for 69 countries in January 2023) is supplemented by the Living Wage data collection.

A typical rent in the lower part of the price distribution (at 25th percentile) and in the middle of the price distribution (median price) is included in the calculation. The housing cost for a family or an individual refers to a typical rent for a two-bedroom apartment respectively an one-bedroom apartment in an average urban area, outside the city centre, not centrally located, nor up-market, but also not located in slums. The housing cost always controls utilities and other costs. The high degree of geographical granularity of the prices collected allows the estimation of the reference housing costs for a large number of regions.

4.4.3 The calculation of transport costs

Transportation is an important cost for households because many people commute for work or travel for daily activities (e.g. shopping). The assumption is that for families the Living Wage does not include the ownership of a motorbike or car and that they have to rely on other means of transportation. As public transport service is commonly available in most places, the price of a regular monthly transport pass is regarded as the transport cost for an adult. The average price of such a monthly pass is used as a meaningful approximation of transport costs, also for families in areas without local public transport. The price of a monthly pass is asked in the WageIndicator Cost-of-Living survey. The cost of transport for a family household is calculated as twice the price of a monthly adult pass. In many places, children commuting to schools can travel for free or with a substantial discount. Therefore, in the Living Wage calculation it is assumed that children travel for free.

Transport costs related to the job - e.g. the car or the motorbike costs for a taxi driver or a rider - are only used to calculate the Living Tariff for platform workers.

4.4.4 The calculation of personal and health costs

Many countries provide at least basic public health care services. Yet, additional expenses are often required for medication not available from public facilities or for private healthcare in emergency situations. In addition, if households temporarily lose income due to health-related absence from work they still need to be able to cover their basic living expenses. The WageIndicator Cost-of-Living survey asks respondents about the minimal monthly expenses on health care for a family of two adults and two children. Based on this information, the monthly expenditure on health is included in the Living Wage calculation. If the country doesn’t have a free healthcare system, then the cost of the cheapest basic health insurance, covering one person and/or one person and the family is collected and added to the calculation. Given that the healthcare insurance for working adults sometimes includes the partner and/or children, the health expenses for an individual and a family are calculated separately. More data is collected specifically on personal and health care costs: the monthly expenses for period products, birth-control products, personal care products and household cleaning products. These are also added to the calculation of the personal and health component.

4.4.5 Education expenses