1. HOW TO ATTAIN THE LIVING WAGE IN CAMBODIA

According to the experts for Cambodia we surveyed, Living Wages should be significantly above the wage levels currently received by garment workers. Assessing how different actors could contribute to the attainment of the living wage, experts were optimistic about the potential impact of the actions of domestic stakeholders. They did not regard living wages to be attainable only with the involvement of global actors. In their view the coordinated actions of domestic garment manufacturers would suffice, but individual manufacturers could also take important steps in this direction. The experts also saw living wages to be attainable in the Cambodian garment industry through the tools available to the government and they saw further unionization as being instrumental in attaining the living wage.

Since the transfer of sovereignty in 1993, Cambodia’s economic recovery has been based on garment exports. These exports really took off due to the 1999 US-Cambodia Textile and Apparel Agreement (TATA). In TATA, increased access to the US market through higher quota for Cambodian factories was linked to their compliance with Cambodian labour law and international labour standards. Through this link, export incentives were used as a reward for enforcing labour standards. From 2001 garment factory monitoring was integrated in the Better Factories Cambodia (BFC) program, led by the ILO and involving government, employers’ association and trade unions. The growth of Cambodia’s garment industry has been driven by foreign direct investment (FDI). Over the years, more than 90 per cent of approved investment in garment production has gone to foreign owners mainly from China, Taiwan and South Korea. Observers have argued that this FDI-based integration into global supply chains has seriously limited policies aimed at improving the country’s competitive position through product innovation and diversification. For 2015 we estimated 500,000 employed in Cambodia’s garment industry of which 410,000 women.

2. MINIMUM WAGES

In Cambodia, separate minimum wage legislation does not exist. The Labour Code of 1997 regulates all labour laws. The minimum wage in Cambodia is only set for the garment and shoe-making industry, based on occupational levels for respectively regular and probationary workers and apprentices. The tripartite Labour Advisory Committee (LAC) should have been instrumental here. By January 1, 2016, the government set the minimum wage was KHR 560,000 for a regular employee (including benefits USD 140, was KHR 512,000) and KHR 540,000 (was KHR 492,000) for a probationary worker. The experts for Cambodia we surveyed agreed that the LAC should act to ensure faithful negotiations between employers and unions and should play a role in seeking consensus. Government and employer organizations were seen as having had the largest influence in setting and adjusting the minimum wage, followed by global buyers and first tier garment companies.

3. COMPLIANCE

The experts estimated the union density in the Cambodian garment industry at between 61 and 80 per cent. A 2010 survey came at 58 per cent – either way union density would appear to be the highest of all industries across Asia. However, a considerable number of factory unions remains, often more than one per factory, which according to experts leads to unsound union rivalry and, jointly with political strings attached, compromises unions’ effectiveness. Collective agreements are only agreed at enterprise level, and experts estimated that they cover less than 20 per cent of garment workers.

There is evidence that over time compliance of Cambodia’s garment factories has overall improved and that the BFC program has been instrumental here. BFC reporting shows that recently compliance rates with wages and related issues, including minimum wage rates, were quite high. By contrast, there are indications that occupational health and safety remains a critical factor in many Cambodian garment workplaces. Apart from BFC the largest potential of pressure towards labour compliance seems to rest with major US and European buyers.

4. WAGES IN CONTEXT IN CAMBODIA

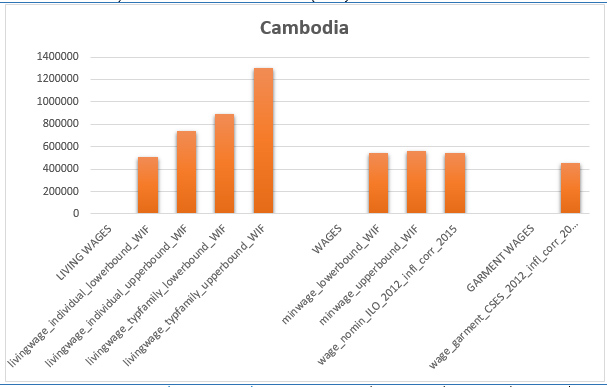

Figure 1: presents wage data for Cambodia: the monthly amounts of the living wages, the minimum wages, the average wage of all workers in Cambodia, and the average wages of the Cambodian garment workers, based on the Cambodia 2012 Socio-Economic Survey (CSES). The LIVING WAGES section comprises the estimated living wages based on the WageIndicator Cost-of-Living Survey for an individual and for a typical family, with lower and upper bounds. The WAGES section comprises the lower and upper bounds of the national 2015 minimum wages and the nominal wages based on the ILO Wage Database 2012 corrected for inflation. The GARMENT WAGES section depicts wages of garment workers based on micro-data from the CSES 2012, also corrected for inflation to 2015.

The figure and the underlying data show that the CSES-based garment wage corrected for inflation by 2015 is 15 per cent lower than the lowest applicable minimum wage and nearly 20 per cent lower than the minimum wage for regular employees. It is 15 per cent below the overall average nominal ILO-based wage, also inflation-corrected. The garment wage remains about 10 per cent below the lower-bound living wage level estimated for an individual. This living wage is also slightly below the lower bound minimum wage. The upper bound living wage level for an individual settles about 30 per cent above the levels of the minimum wages and the average wages, and 40 per cent higher than the CSES-based garment wage corrected for inflation.

Figure 1. Living wages, minimum wages, total wages and garment wages in Cambodia, monthly amounts in Cambodia Riel (KHR)

Source: Wages in Context in the Garment Industry in Asia. Amsterdam: WageIndicator Foundation, April 2016.

5. CAMBODIA COMPARED

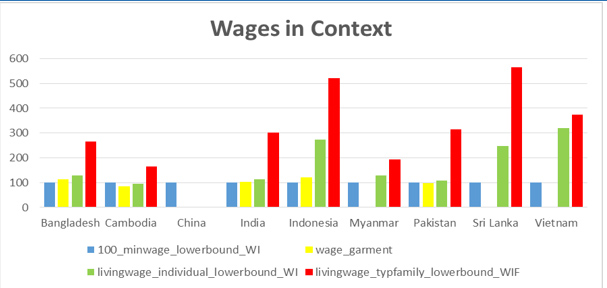

Figure 2 shows wages in context: the distances between the various wage levels calculated for the nine countries, setting the lower bound statutory minimum wage as 100 and relating this to the garment wages derived from official surveys as well as the estimated lower bound living wages for individuals and for typical families. In all five countries with official garment wages available, these wages are not far from the lower bound minimum wage; in two out of the five they even settle below that minimum wage, in Cambodia substantially (15%) and in Pakistan slightly.

In the eight countries (all except China) for which based on the WageIndicator Cost-of-Living Survey living wages could be estimated, the relative levels of the lower bound living wage for individuals vary widely. Cambodia is the only country where this living wage settles slightly below the lower bound minimum wage; for the other countries the individual living wage values range from 8 per cent (Pakistan) and 14 per cent (India) above the lower bound minimum wage up to 29 per cent (Bangladesh and Myanmar), 146 per cent (Sri Lanka), 174 per cent (Indonesia) and 219 per cent (Vietnam).

Figure 2: Wages in Context: Lower bound statutory minimum wage (=100, blue bars) related to the median garment wages (yellow bars), the lower bound living wage for individuals (green bars), and the lower bound living wage for typical families (red bars), nine countries

Source: Wages in Context in the Garment Industry in Asia. Amsterdam: WageIndicator Foundation, April 2016.

Wages in Context in the Garment Industry in Asia

This leaflet is based on a study undertaken for the Ministry of Foreign Affairs, the Netherlands, on behalf of the Asian Living Wage Conference (ALWC) in Pakistan in 2016. The ALWC aims to engage Asian textile-producing countries in the initiatives of EU and US brands and multi-stakeholder initiatives to implement living wages. The Ministry has asked the WageIndicator Foundation to prepare input for the Conference by providing insight into the cost of living and related living wage levels in the garment industries in Bangladesh, Cambodia, China, India, Indonesia, Myanmar, Pakistan, Sri Lanka, and Vietnam.

See Van Klaveren, M. (2016) Wages in Context in the Garment Industry in Asia. Amsterdam: WageIndicator Foundation, April.

http://www.wageindicator.org/main/Wageindicatorfoundation/publications

WageIndicator Cost-of-Living and Living Wage levels calculations

WageIndicator maintains a Cost-of-Living survey with related Living Wage calculations, as well as a Work-and-Wages survey, a Minimum Wages Database, and a Labour Law Database for some 80 countries. For this report, WageIndicator intensified the Cost-of-Living data-collection in the nine countries, and interviewed experts from the nine countries regarding the hurdles to implement Living Wages.

Three features are critical in the WageIndicator Living Wage computations. First, they are based on the cost of living for a predefined food basket derived from the FAO database distinguishing 50 food groups with national food consumption patterns in per capita units (checked to ensure the percentage of calories from proteins is consistent with WHO balance diet), for housing and for transportation, with a margin for unexpected expenses. Second, data about prices of these items is collected through a survey. For this purpose, the Internet is used as it reaches out to large numbers of people. This WageIndicator Cost-of-Living Survey invites web visitors on all WageIndicator websites to complete the survey for a single item or for the list of items. The survey is a multi-country, multilingual, continuous web survey, with a printed version and an App for offline data-collection. Third, in determining a Living Wage, WageIndicator assumes the Living Wage for a typical family referring to the family composition most common in the country at stake, calculated on the respective fertility rates.

See for information: Guzi, M., and Kahanec, M. (2014) Wageindicator Living Wages, Methodological Note. Bratislava/Amsterdam: CELSI/Wage; Guzi, M., Kahanec, M., Kabina, T. (2016) Codebook of the WageIndicator Cost-of-Living Survey. Amsterdam: WageIndicator Foundation

WageIndicator Foundation (www.wageindicator.org; office@wageindicator.org)

WageIndicator started in 2001 to contribute to a transparent labour market for workers and employers by publishing easily accessible information on a website. It collects, compares and shares labour market information through online and face-to-face surveys and desk research. It publishes the collected information on national websites, thereby serving as an online library for wage information, Labour Law, and career advice, both for workers/employees and employers. The websites attract a large audience, because they publish urgently needed but usually not easy accessible information, in 2015 resulting in more than 32 million visitors.